Investment Intelligence: January 2024 Active Deal Pipeline

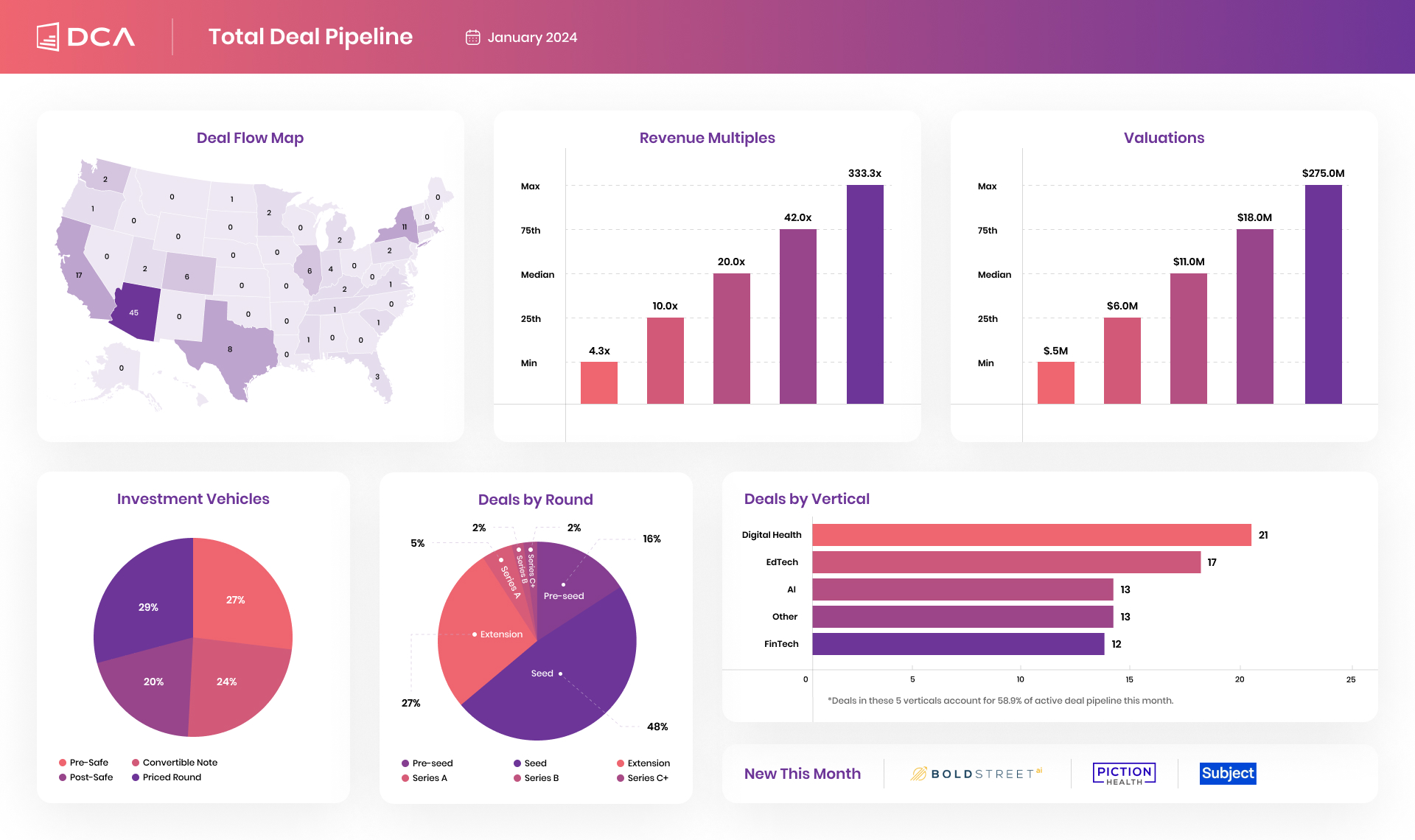

In the fast-paced world of investment, staying ahead of the curve is crucial. At DCA Asset Management, we practice robust data analysis to evaluate potential deals, tracking them on our Active Deal Pipeline. This dashboard provides an in-depth overview of the 120+ deals we’ve investigated over the past 12 months through the end of January 2024.

What Deals Make the List?

Our Active Deal Pipeline consists of deals sourced by DCA in the last year that led to a deeper investigation by our analysts or a conversation with the company founder. As a firm, DCA invests in high-growth-potential startups, with a focus on tech businesses that have the potential to disrupt established industries. Many of our portfolio companies transcend industry lines. Thus, while we remain agnostic to industries and geographies, we highlight some of the more attractive verticals in which our attention and investment dollars are concentrated.

A Bird’s Eye View of the Deal Landscape

Our Active Deal Pipeline presents a dashboard view of over 120 deals that fit our investment model since January of 2023, organized by geography, vertical, investment vehicle, round, revenue multiples, and valuations. This wealth of information helps our analysts enhance deal evaluation and identify lucrative investment opportunities. From this vantage point, we can identify key takeaways from the data on a monthly basis.

We’re happy to share our takeaways from our deal analysis as of January 31, 2024:

Takeaway 1: Coast-to-Coast Assessment of Deals

This year, we had our eyes on a diverse range of deals from across the United States, with Arizona, California, and New York accounting for the most deal activity. With a home base in Arizona, this concentration may not seem surprising, but more than 65% of deals originated outside the Grand Canyon State.

Takeaway 2: Seed Rounds Dominate Investment Landscape

Approximately 50% of deals in our pipeline in the last year were raising Seed rounds, indicating the prevalence of early-stage investments. Furthermore, 33% of deals were raising Seed Extension rounds, signifying the increasing need for additional funding to fuel growth in promising startups.

Takeaway 3: Median Revenue Multiple and Valuation Insights

The median revenue multiple of 9x suggests that companies on our radar have experienced impressive revenue growth. When combined with a median valuation of $10 million, it implies that the median revenue figure for these deals is approximately $1.1 million.

Takeaway 4: Emerging Verticals Showcase Potential

Deals in Digital Health, Pharma, and B2B SaaS verticals emerged as the most prevalent this year, demonstrating their potential for growth and innovation. By focusing on these verticals, our analysts seek to spot trends and capitalize on emerging markets at the forefront of groundbreaking technological advancements.

Unlocking Investment Opportunities: Data Leads the Way

At DCA Asset Management, it is our hope that this look at our Active Deal Pipeline can help provide insights into the past year that will inform the investment community as we enter 2024. We’re committed to leveraging data like this to remain at the forefront of the investment landscape, enabling our firm, and our advisory clients, to thrive in an ever-changing market.

—

*One of DCA’s guiding principles is that we will communicate with our investors and prospective investors as candidly as possible because we believe investors and prospective investors benefit from understanding our investment philosophy and approach. Our views and opinions regarding the prospects of investments and/or the economy are forward looking statements as defined under the U.S. federal securities laws, which may or may not be accurate and may be materially different over future periods. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will,” “may,” “should,” “plan,” or the negative of such terms and similar expressions identify forward looking statements. Forward looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from an investor’s historical experience and current expectations or projections indicated in any forward looking statements. These risks include, but are not limited to, equity securities risk, corporate bonds risk, credit risk, interest rate risk, leverage and borrowing risk, additional risks of certain investments, management risk, and other risks. We disclaim any obligation to update or alter any forward looking statements, whether as a result of new information, future events, or otherwise. You should not place undue reliance on forward looking statements, which speak only as of the date they are made.