Investment Intelligence: Q2 Active Deal Pipeline Insights

Discover the latest insights from DCA Asset Management’s updated deal pipeline, offering a comprehensive overview of the firm’s Q2 2024 investment data. Staying ahead of the curve is crucial in the fast-paced investment world, and DCA continues to use its data-driven strategy to inform investment decisions and identify potential opportunities for its clients.

For historical context, we invite you to take a look back at our 2023 Active Deal Pipeline and Q1 2024 Active Deal Pipeline.

What Deals Make the List?

Our Active Deal Pipeline consists of deals sourced by DCA in 2024 that led to deeper due diligence by our investment team. As a firm, DCA seeks to invest in high-growth-potential startups, with a focus on tech businesses that have the potential to disrupt established industries. Many of our portfolio companies transcend industry lines. Thus, while we typically remain agnostic to industries and geographies, we highlight some of the top deals and core verticals our team was focused on in Q2.

Q2’24 Deal Spotlight

The firm’s refined deal sourcing and scouting processes increased quarterly deal volume QoQ, which in turn increased the quality of deals, specifically within the firm’s target verticals. One of Q2’s strongest deals was a Series A fintech platform streamlining B2B merchant payments and payment data networks. With 200% y/y ARR growth and an impressive Net Revenue Retention rate of >150% across enterprise contracts, this was a top-quartile deal for the quarter. The firm continues to increase deal flow quantity and quality through a strong co-investor network and proprietary deal-sourcing processes.

A High-Level Look at Q2 2024

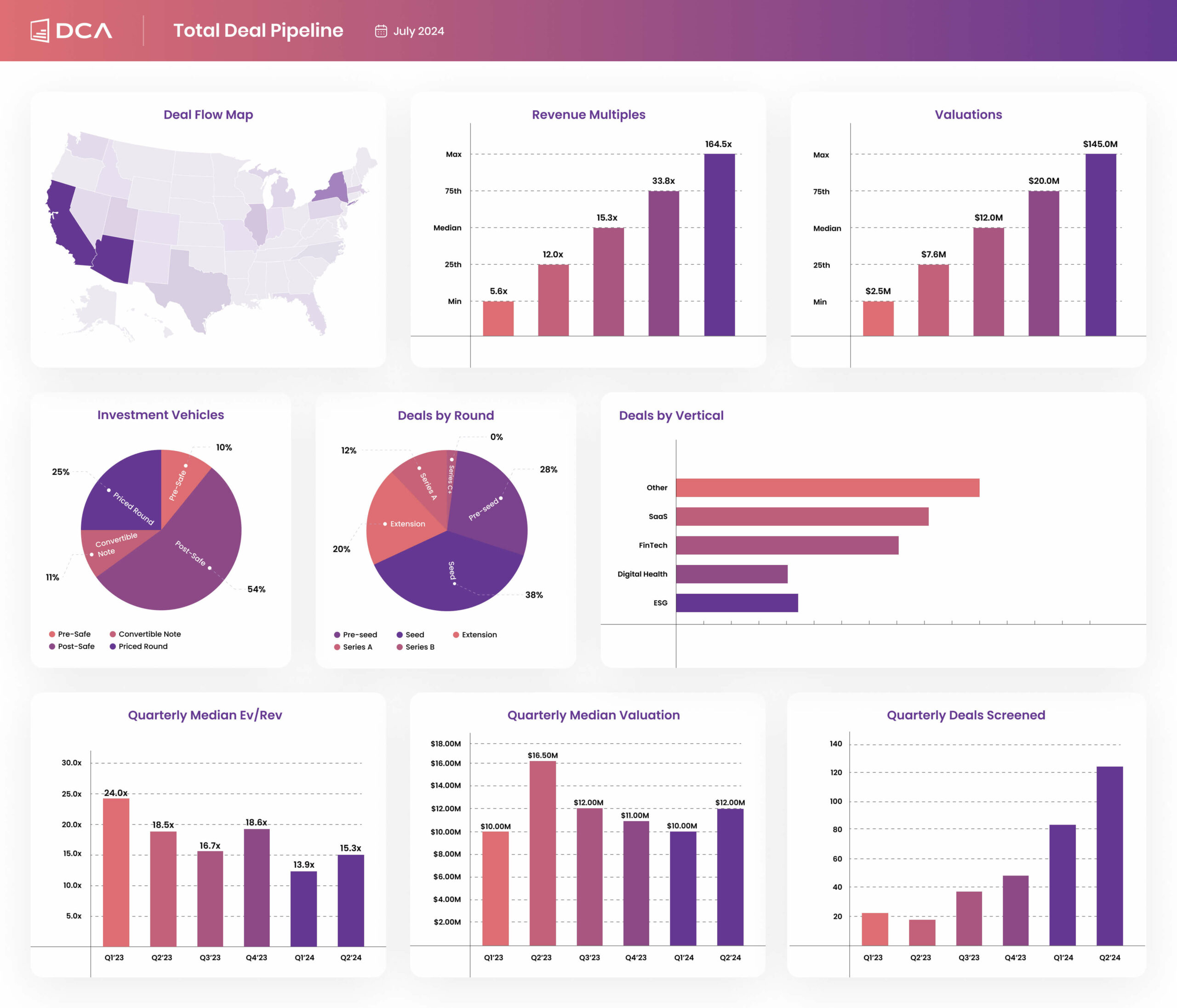

Of the 300+ deals sourced in Q2’24, DCA screened 126 deals that met the firm’s initial investment benchmarks. This marked a significant increase from the previous quarter, reflecting the firm’s revamped scouting and deal-sourcing processes.

Below, we present key data points and trends based on the 126 deals screened in Q2, showcasing how DCA is navigating the dynamic early-stage VC market.

Investment Vehicles: Rising Prevalence of SAFE Notes

Over 64% of Q2’24 deals were raised on SAFE notes, illustrating the prevalence of SAFEs in the early-stage VC market. This data emphasizes the growing comfort among investors with larger dollar amounts raised on SAFEs and the introduction of side letters into many deals. While DCA understands the attraction to SAFE notes for those raising smaller rounds, early-stage investors and founders need to understand the inherent risks of SAFEs, including lack of investor rights protection in future priced rounds, lack of formal governance structure, and cap table complexity/investor perception of raising multiple SAFE rounds at different valuations.

Verticals: SaaS and AI Sectors Dominate

B2B SaaS (30%) and AI (22%) emerged as the two largest vertical segments screened in Q2’24, signaling DCA’s strong focus on these areas. Additionally, Digital Health (12%) and Fintech (11%) were significant verticals in the firm’s Q2 deal flow, which screened deals from over 20 different verticals with a core focus on the firm’s target verticals of AI, Vertical SaaS, Digital Health, Fintech, & Edtech.

Valuation: Mid-Year Surge

The median valuation across all Q2’24 screened deals was $12M, representing a 20% increase from the previous quarter. This increase was primarily driven by a surge in AI deals and larger rounds, commanding higher valuations.

Geography: Deal Diversity Continues

California (26%) and New York (17%) accounted for almost half of Q2’24 deal flow, reflecting DCA’s geography-agnostic investing strategy and a robust co-investor network. Additionally, deals were screened from over 19 different states and four countries in Q2’24 alone, highlighting DCA’s extensive reach.

Funding Stages: Seed and Seed Extensions Lead the Way

Over half (58%) of the deals screened in Q2’24 were in the Seed and Seed Extension rounds, with 28% of deals in the Pre-Seed stage and the remaining 14% in Series A+. DCA continues to actively source early-stage VC deals with a preference towards Seed but maintains an opportunistic approach across the entire early-stage investment curve.

Data-Driven Deal Analysis

As DCA Asset Management remains dedicated to leveraging data-driven strategies to inform its investment decisions, these insights from the Q2 Active Deal Pipeline offer a glimpse into the firm’s investment philosophy and approach.

—

*One of DCA’s guiding principles is that we will communicate with our investors and prospective investors as candidly as possible because we believe investors and prospective investors benefit from understanding our investment philosophy and approach. Our views and opinions regarding the prospects of investments and/or the economy are forward looking statements as defined under the U.S. federal securities laws, which may or may not be accurate and may be materially different over future periods. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “will,” “may,” “should,” “plan,” or the negative of such terms and similar expressions identify forward looking statements. Forward looking statements are subject to certain risks and uncertainties that could cause actual results to materially differ from an investor’s historical experience and current expectations or projections indicated in any forward looking statements. These risks include, but are not limited to, equity securities risk, corporate bonds risk, credit risk, interest rate risk, leverage and borrowing risk, additional risks of certain investments, management risk, and other risks. We disclaim any obligation to update or alter any forward looking statements, whether as a result of new information, future events, or otherwise. You should not place undue reliance on forward looking statements, which speak only as of the date they are made.